New Flood Hazard Maps for Decatur County

What Property Owners Should Know

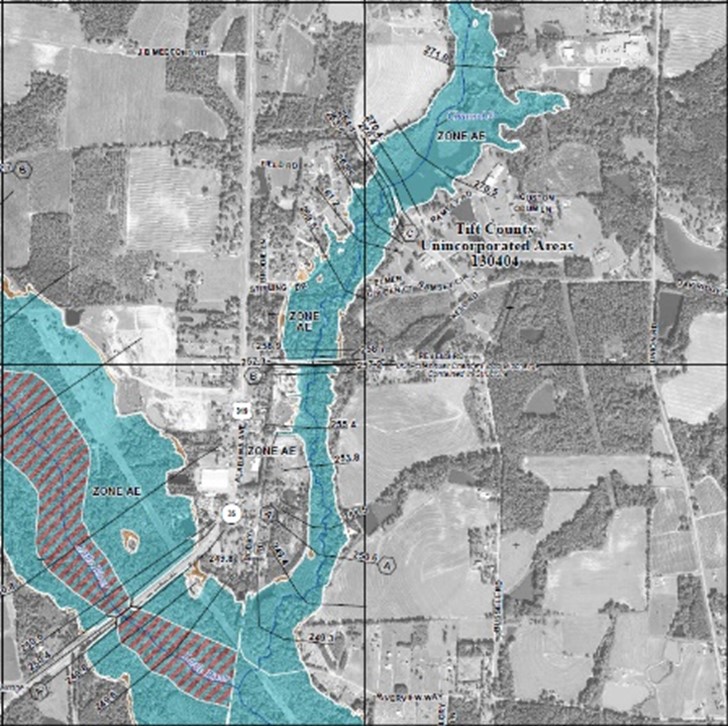

IDENTIFYING THE RISK

The first step in reducing flood risk is knowing your flood risk. Flood risks vary from neighborhood to neighborhood and even property to property, and they can change over time.

The likelihood of flooding in some areas has increased due to new development and environmental changes.

New detailed, digital flood hazard maps have been developed to show current risk levels for the Lower Flint Watershed in Decatur County. The new maps, known as Flood Insurance Rate Maps (FIRMs), replace maps that are based on outdated studies. Planners, local officials, engineers, and builders will use the new maps to help determine where and how to safely build new structures and developments.

Residents and business owners can use the maps (FIRMs) to learn their flood risk and decide the financial and physical steps they need to take to protect against damage and loss.

FLOOD MAPS AND FLOOD INSURANCE

With the release of the new flood hazard maps, some property owners will learn that their risk is higher, or lower, than they thought. Others may find out that their Base Flood Elevation (BFE)1 has changed. A change in risk level can affect what you pay for flood insurance. Flood insurance is a federally underwritten program that helps homeowners, business owners, and renters repair or replace buildings and their contents after a flood.

If you have a loan through a federally regulated or insured lender and are in a high-risk area (flood zones labeled with letters beginning with A or V), the federal government requires you to carry flood insurance as a condition of your loan.

However, if you already have a flood insurance policy in place when you are mapped into a high-risk area, your premium can be calculated using the lower risk zone shown on the earlier map. The National Flood Insurance Program (NFIP) provides rating options to help reduce your cost. So, having a policy in advance not only will reduce the financial impact when a flood occurs, but can also save you money. The chart below helps explain your options.

1 A BFE is the level that flood waters have a one-percent chance of reaching or exceeding in any given year.

IF MAPS SHOW | THESE REQUIREMENTS, OPTIONS AND SAVIGS APPLY |

Change from moderate or low flood risk to high-risk (e.g., flood Zone B, C, or X to Zone A, AE, AH, AO) | Flood insurance is mandatory. Flood insurance will be federally required for most mortgage holders. Insurance costs may rise to reflect the true (high) risk. Rating Options can offer savings. The NFIP provides savings by allowing lower-cost Preferred Risk Policy (PRP) rates to be used the first 12 months after a new flood map becomes effective. Premiums will then increase no more than 18 percent each year. Affected property owners are encouraged to buy a PRP before the maps become effective for additional savings. |

Increase in Base Flood Elevation | An increase in risk can result in higher premiums; however, “grandfathering” can offer savings. The NFIP grandfathering rules allow policyholders who have built in compliance with the flood map in effect at the time of construction to keep their previous zone or BFE to calculate their insurance rate. This could result in significant savings. A grandfather-rated policy can be assigned to new owners at the time of sale. |

Change from high flood risk to moderate or low risk (e.g., flood Zone A, AE, AH, AO to Zone X or shaded X) | Flood insurance is optional but recommended. The risk has only been reduced, not removed. Flood insurance can still be obtained, and at lower rates. More than 35 percent of all Georgia flood insurance claims have occurred in moderate- and low-risk areas. Conversion offers savings. An existing policy can be easily converted to a lower-cost Preferred Risk Policy, if the building qualifies. Note that lenders always have the option to require flood insurance in these areas. |

No change in risk level | No change in insurance rates. However, this is a good time to review your coverages and ensure that your building and contents are adequately insured |

FROM RELEASE TO FINAL ADOPTION

New flood maps are targeted to become effective in Fall 2026. At that time, any related flood insurance requirements will also take effect. The map adoption process includes a round of community meetings, and a review of citizen concerns. Some property owners may feel that even though part of the property is in a high-risk area, the house or commercial structure itself sits high enough to warrant a lower flood insurance rate. An owner who wishes to challenge the new designation will need to prove that the structure is sufficiently above the elevation that a major flood would reach (known as the base flood elevation). For more details on the appeals and comments process, visit www.GeorgiaDFIRM.com.

Mapping Milestones

July 25th, 2024: Preliminary flood maps released

January 27th – February 7th, 2025: Virtual Open House Held; Appointments available

Summer 2025: Start of 90-day Public Comment Period (for filing of appeals and comments)

Summer 2026*: New flood maps take effect; new flood insurance requirements also take effect

Visit www.GeorgiaDFIRM.com to learn more about the mapping process and where and when meetings may be held

For general information, call:

The Environmental Protection Division Southwest District Office at (229) 430-4144

Open Monday – Friday 8 am – 4:30 pm.